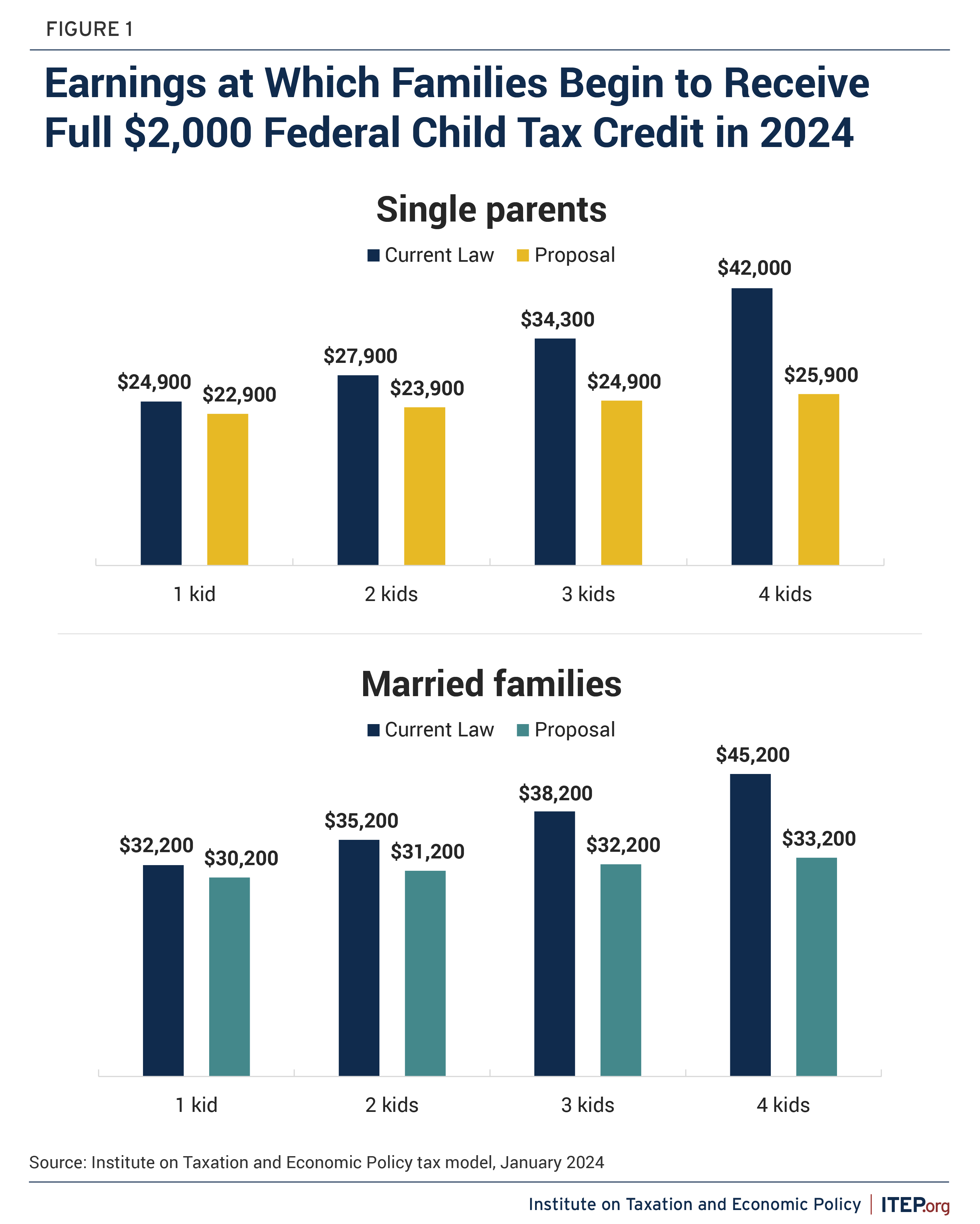

Child Tax Credit Change 2024 – Enhanced child tax credit access: a gradual rise in the refundable segment of the child tax credit would be implemented for the years 2023, 2024, and 2025. Penalties removed for larger families: to . While parents may be shelling out thousands of dollars a month for child care costs alone, they can offset these expenses with two tax credits this season. .

Child Tax Credit Change 2024

Source : itep.org

EV tax credits 2024: VERIFY Fact Sheet | verifythis.com

Source : www.verifythis.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

The $7,500 EV tax credit will see big changes in 2024. What to

Source : www.npr.org

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

2023 and 2024 Child Tax Credit TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit 2024: How much you’ll get per child this year

Source : www.marca.com

Child Tax Credit Change 2024 Expanding the Child Tax Credit Would Help Nearly 60 Million Kids : You may qualify for a slew of new tax credits and deductions depending on your income level. Here is what you should know about the child tax credit for this year’s tax season and whether you qualify. . Congressional negotiators reached a bipartisan agreement on the child tax credit. The deal would to make the child tax credit more generous, boost construction of affordable housing and provide tax .